In response to the extension of certain tax-related measures to continue. The Malaysian Inland Revenue Boardfollowing.

Payment Agreement Template Pdf Templates Jotform

The company can submit their request to IRBM Collection Unit in.

. An increase of 10 on that installment. Each installment payment must be accompanied by a Remittance Slip CP501. The due date for each payment is the 1st day of the relevant month.

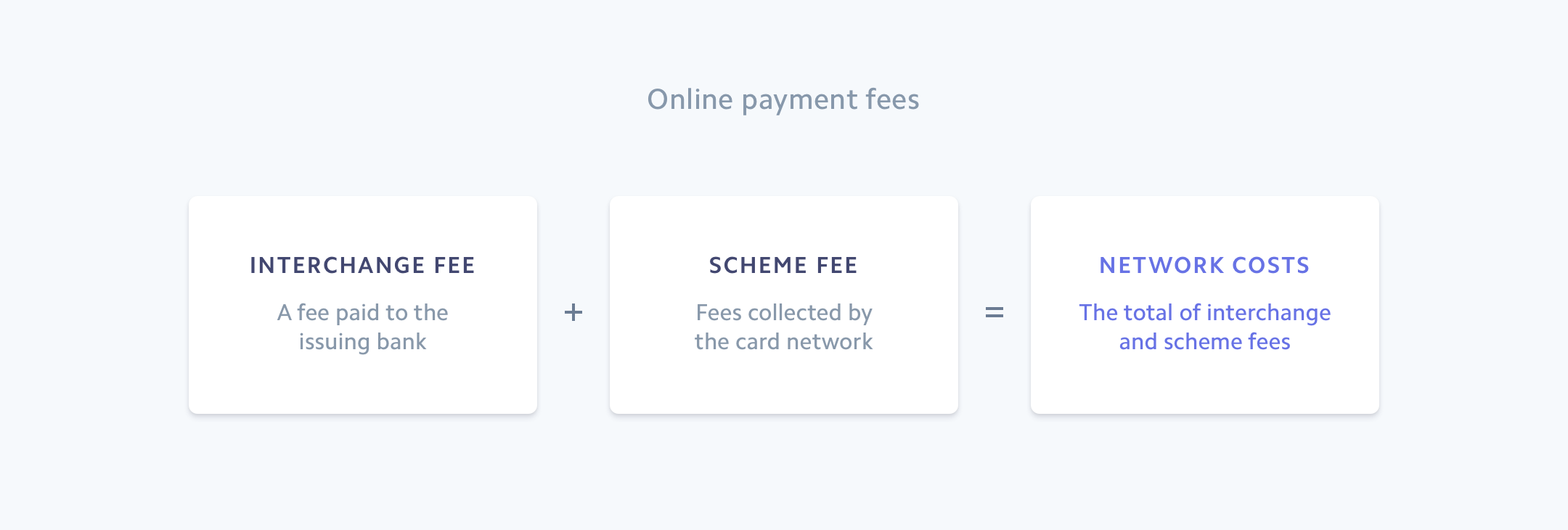

Pay through Direct Debit automatic monthly payments from your checking account also known as a Direct Debit Installment Agreement DDIA. To check whether an organization is. Here are the many ways you can pay for your personal income tax in Malaysia.

The best would be via the IRBs own online platform ByrHASILIts the only online. 2188 Kota Kinabalu Office. By far online payment is the easiest and most efficient way to pay income tax in Malaysia.

If an individual fails to pay the full tax payable for that period the balance of tax to be paid can be reduced by monthly instalment. The procedure is by providing an appeal letter to collection unit. This service enables tax payment through FPX gateway.

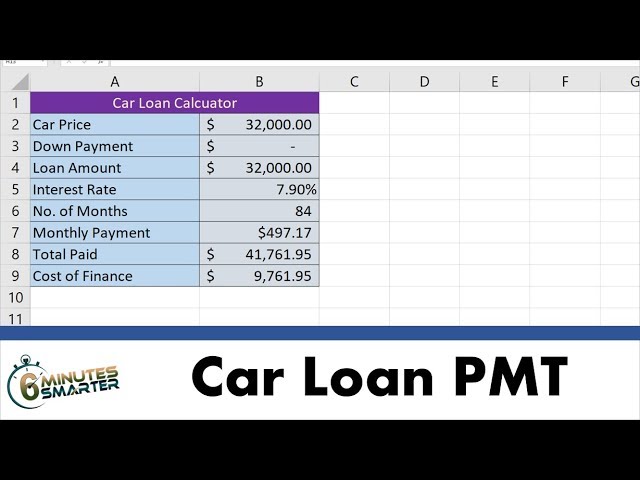

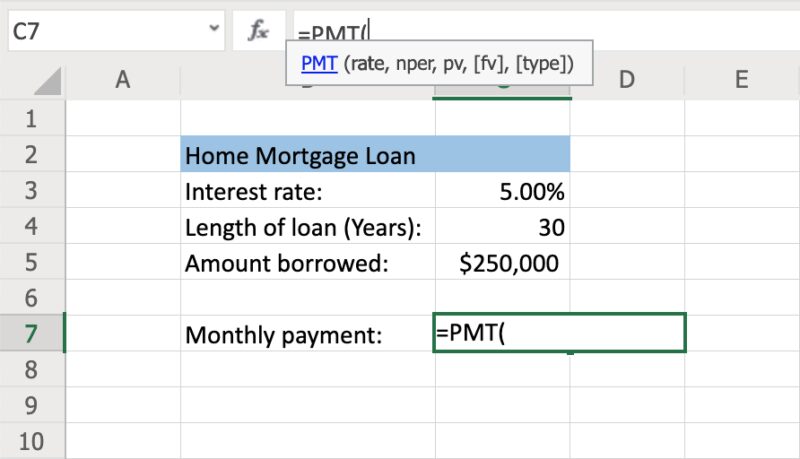

Installment Payment CP204 For existing companies the estimated tax payable has to be paid in equal monthly installments beginning from the second month of the basis period for a year of. Investigation Composite Advance and Instalment Payment. Income Tax Payment other than instalment.

Income tax payment can be made by credit card Issued by Malaysia bank in Malaysia. IRBs FAQs on revision of estimate of tax payable and deferment of tax instalment payments arising from COVID-19 measures. Title title Google Pixel 3 - 32 GB - Midnight Blue with 12 monthly payments.

Income Tax Payment excluding instalment scheme 7. As highlighted in earlier alerts a number of tax. Guidance FAQs on estimated tax payments for all businesses deferred tax instalments for SMEs.

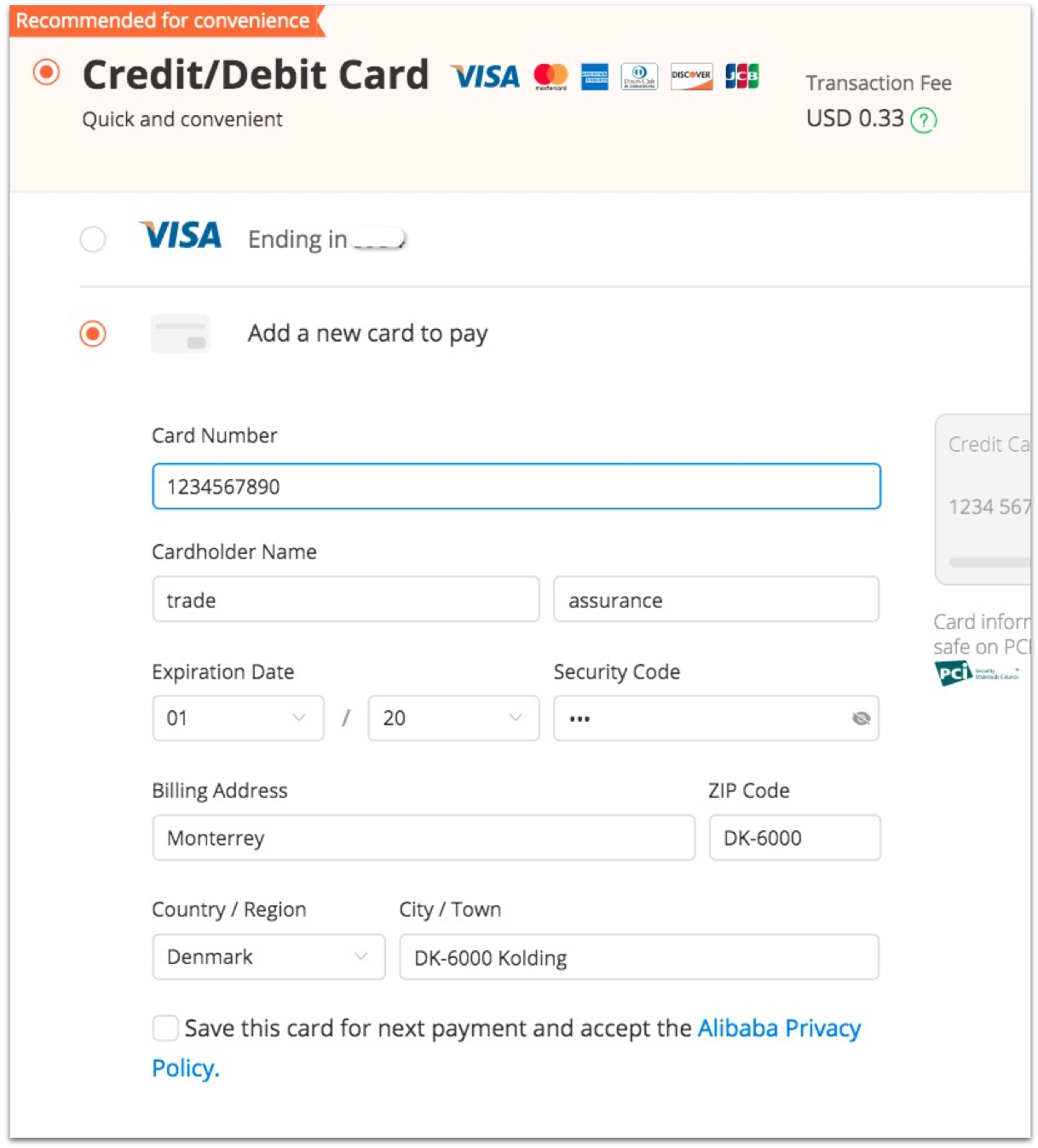

Each installment payment must be accompanied by a Remittance Slip CP501. Real Property Gain Tax Payment RPGT 5. These services can be used for all creditdebit cards VISA.

By far online payment is the easiest and most efficient way to pay income tax in Malaysia. The monthly instalment payment will begin on the 6th month of the basis period for the Year of Assessment 2019 which is from September 2019 to May 2020. Monthly Tax Deduction MTD 6.

User is required an internet banking account with the FPX associate. Additional relief available regarding tax estimates MSMEs installment payments in Malaysia. Under the PEMERKASA Stimulus Package announced by the Government on 17th March 2021 it was proposed that deferment of tax instalments be granted to companies in the tourism and.

If company unable to pay their balance of tax by the due date the company can apply to pay the balance by instalments. Tax Monthly Instalment Payment Balance of Tax - Company. However credit card charges of 080 will be imposed on your income tax payment.

0 Installment Plan What Is Credit Score Saving Money Chart Credit Score

Contractor Payment Schedules What S The Best For My Project

How To Calculate Monthly Loan Payments In Excel Investinganswers

Tax Payment How To Pay To Lhdn With M2u Youtube

Stripe Introduction To Online Payments

Advance Payment Invoice Template 9 Free Docs Xlsx Pdf Invoice Template Invoice Format Microsoft Word Invoice Template

Boat Sale And Purchase Agreement Template Nz The Seven Secrets About Boat Sale And Purchase Cars For Sale Project Cars For Sale Sell Car

Free Payment Plan Agreement Template Word Pdf Eforms

Free Payment Plan Agreement Template Word Pdf Eforms

How To Write Invoice Payment Terms Conditions Best Practices

Introducing The Payment Element

Free Payment Plan Agreement Template Word Pdf Eforms

Connecting Paypal As A Payment Provider Help Center Wix Com

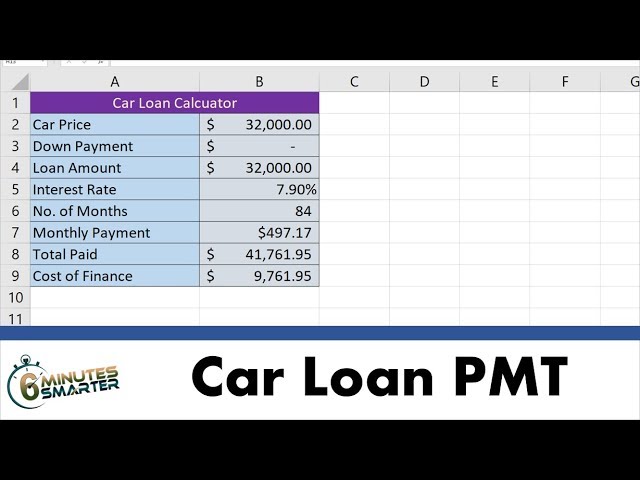

Use The Pmt Function To Calculate Car Loan Payments And Cost Of Financing Youtube

Free Payment Plan Agreement Template Word Pdf Eforms

/interestcoverageratio_final-9c844b89a7744514b53bc16618a6fc9d.png)